Recently I read an article about the probability of cancer risk. It is calculated what is the percentage of cancer risk both for male and female.

While Female has a percentage of cancer risk at breast cancer 8 to 1, rectum and colon cancer 22 to 1 , non-hogkin lenfoma cancer 51 to 1, skin cancer 53 to 1, thyroid cancer 62 to 1, pancreas 68 to 1, kidney cancer 83 to 1, leukemia cancer 86 to 1,Males has a percentage of cancer risk prostate cancer 7 to 1, lung cancer 13 to 1, rectum and colon cancer 20 to 1, urinary 26 to 1, skin cancer 34 to 1, non – Hodgkin lenfoma cancer 42 to 1, kidney cancer 49 to 1, leukemia cancer 60 to 1, throat cancer 66 to 1 and liver cancer 82 to 1.

These statistics shows that it doesn’t matter which geography, country, religion and country we are from and we may assume having a cancer is almost a faith. Anyway I really wonder the mathematical probability of all these various cancer risks at once.

We can accept the same approach for Risk. If we accept life is risk or risk is a part of life, subject will be the answers to the question how are we going to manage risk.

To have a healthy life there are some tests for early diagnosis as mammogram for breast cancer and after tests research and treatment begins.

For early diagnostic to social, political, economic risks, there are various statistics measurement and evaluation system , but treatment not always bring a solution just because of sudden changes of agenda and problems become chronic.

We should have a short look to recent news and events which indicates these chronic items.

- Baltıc Dry index which indicates the world economic growth trend decreases to its deepest level over 31 years.

- Texas crude oil price (WTI) decreases to 29,69 Usd.

- Crude oil price was 102,59 on February 2014 and 29,69 usd now

- Minister of Iraq declares that they have lost % 70 of their national income.

- Norway call crises after the decrease of oil prices under 30 usd.

- Saudi Arabia raise fuel prices over % 50.

- Qatar raises fuel prices over % 30

- Economic stimulus comes from RBS & Societe Generale. RBS advice to sell everything and hold only high quality bonds.

- London Societe Generale analyst Albert Edwards, “ developed countries hit by the emerging markets deflation wave and central banks oblivious of the disaster going to hit them.

- The famous investment expert Marc Faber declares China have a huge debt balloon and added we have noticed a big decrease on merchandise prices and now we may see a rigorous decrease at economies.

- Famous investor Soros declares that China has difficulty to find a new model of growth and added spread the problems of its Yuan devaluation to other countries. He also pointing that orientation to positive interest will be a big problem for the world.

- Only in four days Shangai index loss comes to % 12. The panic sales at China exchange influence both the regional countries and also the other countries.

- Foreign investor at IMKB sales the biggest amount of last seven year.

- BBDK begins a new work for banks to protect them against the global crises. According to authorities the loss of TL value and capital adequacy ratio causes to this action.

- The global markets follow a negative trend with the loss of China exchange and the rigorous decrease of Yuan against Usd despite the FED optimistic reports.

- The most harm from FED’s possible interest rate increase will affect Russia and Egypt.

- It is also speculated that if Saudi Arabia can’t provide the investment flow and the vulnerability on the national income may occur a bankruptcy.

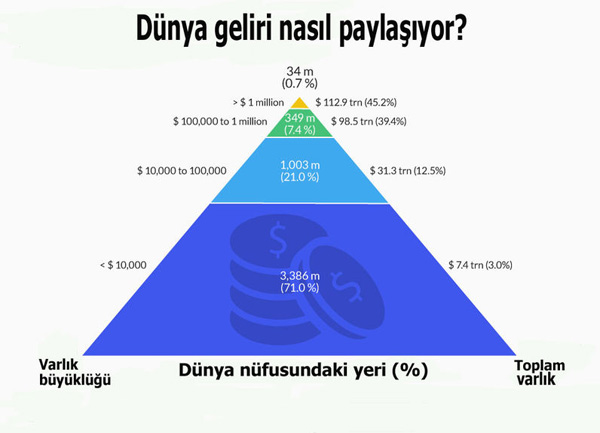

Besides the economic news we have to remember the wars and various low intensity warfare still going on. This is the point we should also remember the % 07 of world population possess the % 45.2 of world income and % 7.4 of world population have the rest of % 39.4 world income. (This news on press explains this distribution % 1 of world population possess % 99 of world national economy)

After the world economic crises at 2008 Capitalism insist on initiatives capturing the natural sources even though damaging the balance of the nature and destroying the national income worse. Unfortunately we realize wars consistently continue hostilities as it happens Iraq – Iran – Syria – Egypt -Ukraine – Mali – Yemen – Sudan. When we look the question “what’s going on “ with a perspective “ What we should do” the answer is, people and the actors of economy should give the importance to risk management as a priority and being as a union adopting a sustainable consistent policy highlighting human and nature .

The prior risk subjects of 2016 can be listed below;

- Geopolitical risk Russia – Syria – Iraq

- Terrorism, the law intensity warfare at east and south east board of Turkey, bombing at big cities.

- Tourism income decrease risk, German and EU countries terror perception after Russian plane attack and Sultanahmet bombing.

- Lack of foreign capital risk after FED increasing interest rates. And the pressure of TCMB not to increase the interest rates.

- Foreign currency risk, devaluation risk because of low interest rates, bank risk which may easily affected from sudden currency increases.

- Credit note risk

- The pressure of inflation as a result the risks listed above

- Possibility of the increase of oil and raw material prices may cause to inflation.

Having the biggest share at economics Small Business Enterprises should give high importance to risk management they ever had. BCD’s one of proficiency is giving service to SME’s on risk management .

BCD Business Development and Consultancy Ender Balcı

Risk Management What’s Going On?

While Female has a percentage of cancer risk at breast cancer 8 to 1, rectum and colon cancer 22 to 1 , non-hogkin lenfoma cancer 51 to 1, skin cancer 53 to 1, thyroid cancer 62 to 1, pancreas 68 to 1, kidney cancer 83 to 1, leukemia cancer 86 to 1,Males has a percentage of cancer risk prostate cancer 7 to 1, lung cancer 13 to 1, rectum and colon cancer 20 to 1, urinary 26 to 1, skin cancer 34 to 1, non – Hodgkin lenfoma cancer 42 to 1, kidney cancer 49 to 1, leukemia cancer 60 to 1, throat cancer 66 to 1 and liver cancer 82 to 1.

These statistics shows that it doesn’t matter which geography, country, religion and country we are from and we may assume having a cancer is almost a faith. Anyway I really wonder the mathematical probability of all these various cancer risks at once.

We can accept the same approach for Risk. If we accept life is risk or risk is a part of life, subject will be the answers to the question how are we going to manage risk.

To have a healthy life there are some tests for early diagnosis as mammogram for breast cancer and after tests research and treatment begins.

For early diagnostic to social, political, economic risks, there are various statistics measurement and evaluation system , but treatment not always bring a solution just because of sudden changes of agenda and problems become chronic.

We should have a short look to recent news and events which indicates these chronic items.

Besides the economic news we have to remember the wars and various low intensity warfare still going on. This is the point we should also remember the % 07 of world population possess the % 45.2 of world income and % 7.4 of world population have the rest of % 39.4 world income. (This news on press explains this distribution % 1 of world population possess % 99 of world national economy)

After the world economic crises at 2008 Capitalism insist on initiatives capturing the natural sources even though damaging the balance of the nature and destroying the national income worse. Unfortunately we realize wars consistently continue hostilities as it happens Iraq – Iran – Syria – Egypt -Ukraine – Mali – Yemen – Sudan. When we look the question “what’s going on “ with a perspective “ What we should do” the answer is, people and the actors of economy should give the importance to risk management as a priority and being as a union adopting a sustainable consistent policy highlighting human and nature .

The prior risk subjects of 2016 can be listed below;

Having the biggest share at economics Small Business Enterprises should give high importance to risk management they ever had. BCD’s one of proficiency is giving service to SME’s on risk management .

BCD Business Development and Consultancy Ender Balcı